Return on capital employed or ROCE is a profitability ratio that measures how efficiently a company can generate profits from its capital employed by comparing net operating profit to capital employed. In other words, return on capital employed shows investors how many euros in profits each euro of capital employed generates.

This ratio is based on two important calculations: operating profit and capital employed. Net operating profit is often called EBIT or earnings before interest and taxes. EBIT is often reported on the income statement because it shows the company profits generated from operations. EBIT can be calculated by adding interest and taxes back into net income if need be.

Capital employed is a fairly convoluted term because it can be used to refer to many different financial ratios. Most often capital employed refers to the total assets of a company less all current liabilities. This could also be looked at as stockholders’ equity less long-term liabilities. Both equal the same figure.

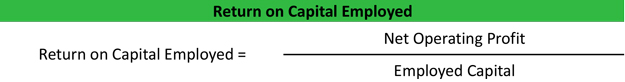

Formula

Return on capital employed formula is calculated by dividing net operating profit or EBIT by the employed capital.

Any queries give me a call on 091 763817 or email me on Oliver@taxreturnhelp.ie